How a Free Paycheck Creator Helps Manage Overtime Payments

Managing payroll can be challenging, especially when handling overtime payments. Whether you’re a small business owner, freelancer, or self-employed entrepreneur, ensuring accurate overtime pay is essential for compliance and employee satisfaction. A free paycheck creator simplifies this process by automating calculations and reducing errors.

Understanding Overtime Pay

Overtime pay applies when an employee works beyond their standard hours. In the U.S., federal law mandates that non-exempt employees receive 1.5 times their regular hourly wage for overtime hours worked beyond 40 in a week. Employers must track these hours accurately to comply with labor laws.

The Challenges of Overtime Payroll Management

Without a structured payroll system, calculating overtime can lead to:

-

Errors in wage calculations, causing underpayments or overpayments.

-

Compliance issues, leading to potential fines and legal trouble.

-

Time-consuming manual processing, increasing workload for business owners.

A free paycheck creator eliminates these problems by providing a streamlined payroll process.

How a Free Paycheck Creator Simplifies Overtime Payments

A free paycheck creator automates calculations, ensuring accurate payroll management. Here’s how it helps:

1. Automated Overtime Calculations

Manual calculations can result in errors, but a paycheck creator automatically factors in:

-

Hourly wage

-

Overtime rates

-

Total hours worked

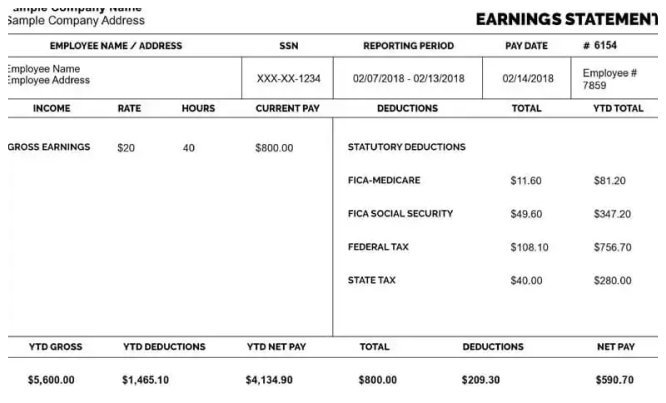

2. Accurate Deductions and Withholdings

Tax and benefits deductions can be complex. A free paycheck creator ensures:

-

Correct tax withholdings based on state and federal laws.

-

Automatic deductions for Social Security, Medicare, and other benefits.

3. Error-Free Paycheck Generation

A free paycheck creator minimizes errors by eliminating miscalculations and ensuring compliance with labor laws.

4. Easy Record-Keeping

Maintaining accurate payroll records is crucial for tax filings and audits. A paycheck creator allows employers to:

-

Store digital pay stubs for easy access.

-

Track past payments and overtime hours.

5. Time and Cost Savings

Hiring a payroll specialist can be expensive. A free paycheck creator saves time and costs by offering:

-

Instant paycheck generation

-

No need for costly payroll software

Steps to Use a Free Paycheck Creator for Overtime Payments

-

Enter Employee Details – Input names, contact details, and job roles.

-

Input Work Hours – Include standard and overtime hours worked.

-

Calculate Gross Pay – The system will apply correct overtime rates.

-

Deduct Taxes and Benefits – Automatic tax and benefits deductions ensure accuracy.

-

Generate and Download Paycheck – Review the details and download the final paycheck.

Why Businesses Should Use a Free Paycheck Creator

Using a free paycheck creator is beneficial for:

-

Small businesses needing an efficient payroll solution.

-

Freelancers tracking multiple payment sources.

-

Entrepreneurs ensuring compliance with wage laws.

Conclusion

A free paycheck creator is an essential tool for managing overtime payments efficiently. It simplifies calculations, ensures accuracy, and helps businesses comply with labor laws. Whether you run a small business or are self-employed, using a free paycheck creator ensures payroll management is stress-free and efficient.

Related Articles

Access Your Pay Information Using eStub in 2025

TruBridge Paystub Not Showing? Here’s What to Do

Why Employer Should Use a Free Payroll Check Stubs Template?

What's Your Reaction?